Tri Merge Credit Report: What Every Homebuyer Needs To Know

Updated: Nov 30, 2023

Thinking about buying a home and feeling a little puzzled about how your credit fits into the picture? Don't worry, you're not alone. After diving deep into the world of mortgage lending procedures, we’ve unearthed some insights on the crucial role tri-merge credit reports play in getting a loan.

This article is designed to demystify these reports for you and equip you with knowledge that could improve your chances of securing your dream home! So let's clear up confusion and dive right in - because understanding your path to homeownership shouldn’t feel like decoding rocket science!

Key Takeaways

✅ A tri - merge credit report combines information from all three major credit bureaus into one comprehensive document, giving lenders a complete view of your credit history.

✅Lenders use your credit score, which is determined by the information in your tri-merge report, to assess your creditworthiness and determine if you qualify for a loan.

✅Factors such as payment history, debt-to-income ratio, employment history, and assets are considered by lenders when evaluating your creditworthiness

✅To improve your chances of getting approved for a loan, manage debt responsibly, make timely payments, maintain a positive credit history, and seek professional help if needed.

Quick Navigation - Click the link below to jump to that section..

What is a Tri-Merge Credit Report?

A Tri-Merge is a type of report that combines the information from all three major credit bureaus into one comprehensive document.

Definition and purpose

A tri-merge gives a comprehensive picture of your credit history by combining information from all three national credit bureaus. It's critical for lenders because it aids them in understanding your financial behavior before committing to lending you substantial funds.

The elements within the report include your loan accounts, payment consistency, and any instances of late or missed payments. These reports serve a dual role – they help lenders assess if you will make timely payments and also enable you to understand where your finances stand when planning to buy a home.

They are an essential tool both for securing loans and managing personal finance efficiently.

Information included

A tri-merge gathers detailed financial data from all three national credit bureaus. This gathered information provides a comprehensive view of your personal financial behavior, including facts about your established credit card accounts and loan accounts.

It goes beyond listing your debts; it also records consistency in payment history, with special attention given to any late or missed payments. Additionally, the tri-merge report documents other crucial elements like any recorded bankruptcies, tax liens, or even foreclosures that may have happened in the past seven years.

The FICO score is essentially a numerical representation of these details found in your tri-merge report and plays an imperative role towards mortgage eligibility.

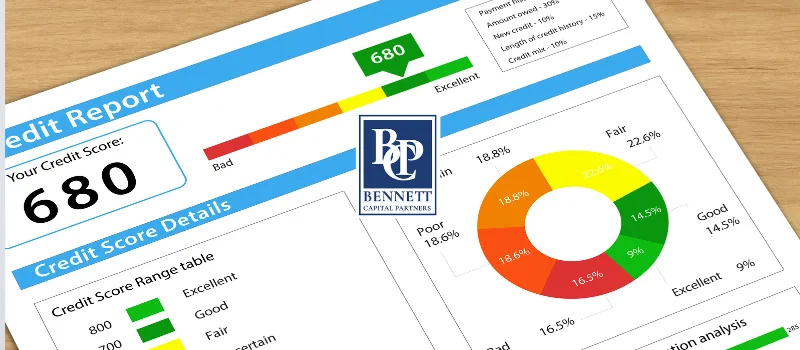

Understanding Your Credit Score for a Mortgage Loan

Your credit score is a key player in qualifying for a loan. It's more than just a number; it reflects your financial responsibility. Mortgage lenders, like us, scrutinize scores to assess the risk associated with lending you money.

The scale ranges from 300 (poor) to 850 (excellent), with most lenders considering individuals with scores of 740 or above as prime candidates for a mortgage.

A tri-merge plays an essential role in determining this all-important score. This type of report includes data from Experian, TransUnion, and Equifax— the three major credit bureaus.

What makes it unique is that instead of having to analyze three separate reports, we get one comprehensive view of your financial history. We gain insight into factors such as any current debt you may have, whether you've made timely payments on existing loans or credit cards, and if there are any significant red flags like bankruptcies or foreclosures in your past.

How Does a Tri-Merge Credit Report Impact Your Mortgage Application?

A tri-merge can have a significant impact on your application as lenders use it to assess your creditworthiness and determine your eligibility for a loan.

Importance of credit scores

Credit scores play a crucial role in the application process. Lenders rely on credit scores to assess your creditworthiness and determine if you qualify for a mortgage. A higher score increases your chances of getting approved for a loan with favorable terms, such as lower interest rates.

On the other hand, a low score can result in higher interest rates or even rejection of your application. It is important to maintain good credit habits, such as making payments on time and managing debt responsibly, to improve your score and increase your chances of securing a loan at favorable terms.

Factors considered by lenders

Lenders consider several factors when assessing your creditworthiness for a mortgage:

📌 Credit Score: Lenders closely review your credit score, which is a numerical representation of your creditworthiness. A higher credit score indicates responsible borrowing and increases your chances of qualifying for a loan.

📌Payment History: Lenders examine your payment history to see if you have made payments on time or if you have any late or missed payments. Consistent, on-time payments demonstrate financial responsibility.

📌Debt-to-Income Ratio: Lenders calculate your debt-to-income ratio by comparing the amount of debt you have to your income. A lower ratio indicates less financial strain and higher chances of affording monthly payments.

📌Employment History: Lenders evaluate the stability and length of your employment history to determine if you have a consistent source of income to cover payments.

📌Assets and Reserves: Lenders consider the assets you have and any reserves you have saved up as additional indicators of financial stability and ability to handle unforeseen expenses.

How to Obtain a Tri-Merge Credit Report?

To obtain a Tri-Merge, you can access it through various options such as contacting the three major credit bureaus (Experian, Equifax, and TransUnion) individually or using online services that provide all three reports in one.

Checking for errors or discrepancies is crucial to ensure accurate information on your report. However, it should be noted that the FICO scoring models are not available to the public. The best way to get your official tr-merge credit report is to get a free quote from Bennett Capital Partners

📞 Call Us Today 305-407-0747

Options for accessing your report

You have a few options for accessing your tri-merge. One way is to visit AnnualCreditReport.com, where you can obtain free copies of your individual credit reports from Experian, Equifax, and TransUnion once a year.

These reports will give you a comprehensive view of your credit history from each bureau. Another option is to use a credit monitoring service, which can provide you with regular updates on changes to your credit report.

Keep in mind that these services may come with a fee, so be sure to do your research before signing up. Finally, if you are currently working with a mortgage lender or credit counselor, they may be able to pull a tri-merge report for you as part of their services.

Checking for errors or discrepancies

It is crucial to thoroughly review your tri-merge for any errors or discrepancies. Mistakes in your credit report can negatively impact your credit score and application.

Look out for misspelled names, inaccurate account information, or payments wrongly marked as late or missed. Discrepancies can be disputed with the respective credit reporting agencies to ensure accurate reporting.

Remember, a clean and error-free report improves your chances of getting approved for a loan. Regularly monitoring your credit and promptly addressing any issues will help you maintain a healthy financial profile.

Tips for Improving Your Credit Before Applying for a Mortgage

To improve your credit before applying for a mortgage, focus on managing your debt responsibly by making timely payments and reducing outstanding balances. Building a positive credit history is also crucial, so consider keeping older accounts open and avoid opening new lines of credit.

If needed, seek professional help from reputable credit counselors who can provide guidance tailored to your specific situation.

Managing debt and payments

To increase your chances of qualifying, it's crucial to manage your debt and payments effectively. Start by making all your monthly payments on time, as any missed or late payments can negatively impact your credit score.

Additionally, try to pay off any outstanding debts or reduce your credit card balances to improve your credit utilization ratio. It's also important to avoid taking on new debt while you're in the process of applying.

By staying on top of your debt and payments, you'll demonstrate financial responsibility and increase the likelihood of getting approved for a mortgage loan.

Building a positive credit history

Having a positive credit history is crucial when applying. Lenders want to see that you are responsible with your finances and have a track record of making payments on time.

To build a positive credit history, focus on managing your debts effectively and making all payments in a timely manner. Avoid maxing out your credit cards and strive to keep your balances low.

Additionally, consider seeking professional help if needed to ensure you are taking the right steps towards improving your credit before applying. By building and maintaining good credit, you increase your chances of getting approved for a home loan.

Seeking professional help if needed

If you're a first-time homebuyer and unsure about how to improve your credit before applying, seeking professional help can make a significant difference. A credit counselor or financial advisor can assist in understanding your credit history and offer guidance on managing debt and payments effectively.

They can also help negotiate lower interest rates, increasing the chances of qualifying for a favorable loan. Professional assistance is valuable in identifying and resolving any negative information on your credit reports, ultimately improving your overall financial standing.

Strategies to Boost Your Credit Score Before Applying for a Mortgage

Boosting your credit score before applying is crucial to increase your chances of approval and secure favorable terms. Here are some strategies to help you improve your creditworthiness:

✅ Pay your bills on time: Consistently making timely payments shows lenders that you are responsible and can be trusted with credit.

✅ Reduce your credit card balances: Aim to keep your credit card balances below 30% of the available limit. Lower balances demonstrate that you can manage your debt responsibly.

✅ Limit new credit applications: Opening multiple new accounts in a short period can negatively impact your credit score. Only apply for new credit when necessary.

✅ Review and dispute errors on your credit report: Regularly check your tri-merge report for any inaccuracies or discrepancies that could be lowering your score. Dispute these errors with the respective credit reporting agencies.

✅ Maintain a healthy mix of credit types: Having a diverse range of credit, such as mortgages, loans, and credit cards, can show lenders that you can handle various forms of debt responsibly.

✅ Keep old accounts open: Closing old accounts may reduce the length of your credit history, which can affect your score negatively. Instead, leave these accounts open and use them periodically to maintain an active payment history.

✅ Work with a reputable credit counseling agency: If you're struggling with debt management or need professional guidance, reach out to a reputable credit counseling agency who can provide personalized advice and assistance.

Conclusion

In conclusion, understanding the importance and impact of a tri-merge is crucial for every homebuyer. This comprehensive report combines information from all three national credit bureaus, providing lenders with a thorough assessment of your credit history.

By managing debt, making timely payments, and seeking professional help if needed, you can improve your credit score and increase your chances of qualifying. Remember to regularly check your tri-merge report for errors or discrepancies to ensure accurate information is being considered by lenders.

Tri Merge Credit Report: What Every Homebuyer Needs to Know

Understanding the Tri Merge Credit Report

➡️Three Credit Bureaus: A tri-merge credit report includes data from all three credit bureaus, consolidating three credit reports into one comprehensive consumer credit report.

➡️Individual Reports vs. Tri Merge: Unlike individual reports, a tri-merge credit report gives a more holistic view of an applicant’s credit history.

➡️Three of Your Credit Reports: This report combines the three separate credit reports and three credit scores into a single credit report, commonly used in mortgage lending.

➡️Credit Scoring Model: The tri-merge credit report uses a specific credit scoring model to provide a comprehensive view of your creditworthiness.

What's Included and What's Not

➡️Tri Merge Credit Score: This is not just one credit score; it's an average of scores from the three credit reporting bureaus.

➡️Information in Your Credit Report: The report may include credit inquiries, payments and credit history, among other data.

➡️Credit Report a Hard Inquiry: Note that ordering a tri-merge report is considered a hard credit pull, different from free credit report options.

➡️Full Credit Report: The tri-merge provides a full credit report, offering a more detailed look than just one credit report from a single bureau.

Why Lenders Use Tri Merge Reports

➡️Lenders Look at Your Tri-Merge: Mortgage lenders specifically look at your tri-merge credit report to assess the borrower’s credit score and borrower's credit history.

➡️Needs of the Mortgage: The tri-merge report is tailored to meet the needs of the mortgage industry, including any credit supplements that may be required.

How to Access Your Tri Merge Report

➡️Free Copy of Your Credit: You're entitled to a free copy of your credit report annually, but a copy of your tri-merge may incur a fee.

➡️Credit Reports Will Give: These reports will give you insights into multiple credit aspects, including credit data and credit inquiries.

➡️Working With a Credit Counselor: If you're looking to improve a high credit score, consider working with a credit counselor who can make credit recommendations based on your borrowers’ credit.

Additional Points to Consider

➡️Report Also Includes: The report will also contain details about credit pull and is often referred to as a three-in-one credit report.

➡️Reports Are Primarily: These reports are primarily used to assess the applicant’s credit report and borrower’s credit.

➡️Credit Bureaus Created: The credit bureaus created this consolidated report to simplify the process for both consumers and lenders.

➡️One Report: While you can order one report from each bureau, the tri-merge combines them for easier interpretation.

➡️Order Tri-Merge: You can order tri-merge reports from various platforms, but ensure you understand what each credit reporting bureaus offers.

FAQs

What is a tri merge credit report?

A tri merge credit report combines data from all three major credit reporting agencies into one single report.

Why should homebuyers consider a tri merge credit report?

Homebuyers need to look at their tri-merge because it provides full visibility of their consumer credit profile, which lenders heavily rely on for mortgage lending decisions.

How can I access my own Tri Merge Credit Report?

You can order your three-in-one or tri-merge credit report from the three major bureaus or through authorized providers as per Fair Credit Reporting Act regulations, including getting a free copy of your merged annual report.

Does ordering a Tri-Merge Credit Report affect my score?

Ordering your own Tri Merge Credit Report is considered an individual inquiry and does not negatively impact your high or low scores like other multiple hard inquiries would do during applications for new lines of type of credits could potentially.

What kinds of information does the Tri Merge Credit Report include?

The merged reports contain detailed information from all separate reports gathered by each bureau about borrowers’ payment history with loans and lines, current debt levels, length of applicant’s open and closed accounts' histories along with recent hard pulls such asborrower's fresh loan applications.

Can working with a counselor help me better understand my Tri Merge Report?

Yes! Professionals like certified counselors can assist in examining your consolidated document thoroughly; they can correctly interpret custom scoring models used by lenders while addressing any discrepancies found across multiple records to maintain accuracy within each referenced raw data point drawn into that singular comprehensive account evaluation.

Philip Bennett

Philip is the owner and Licensed Mortgage Broker at Bennett Capital Partners, Bus. NMLS # 2046828. He earned his degree in Accounting and Finance from Binghamton University and holds a Master's Degree in Finance from NOVA Southeastern University. With more than 20 years of experience, Philip has been a leader in the mortgage industry. He has personally originated over $2 billion in residential and commercial mortgages.

Learn more about Philip Bennett's background and experience on our Founder's page. Whether you're a first-time homebuyer or a seasoned real estate investor, our team is here to help you achieve your real estate goals. Don't wait any longer, contact us today and let us help you find the right mortgage for your needs.

Discover helpful tips and tricks on mortgages by reading our blog posts

Understanding FHA Non-Occupant Co-Borrower Guidelines For Mortgage Loans to learn more about Non-Occupying Co-Borrowers for FHA Mortgages. Click here to read the full article