Explore Our Lot Loan Program: The Best Land Loan In Florida

Updated: Mar 21

Welcome to our comprehensive guide on securing the best lot loan in Florida. Whether you're looking to acquire a vacant plot for your dream home or for investment purposes, understanding the nuances of Florida land loan options is crucial.

At Bennett Capital Partners, we specialize in navigating these complex waters, ensuring you make informed decisions about your land financing needs. Our guide provides valuable insights and expert advice to help you make the most of your land investment journey.

Ready to learn more? We invite you to read on and explore the various aspects of securing a lot loan in Florida.

Key Takeways

✅ Expert Guidance: Bennett Capital Partners provides unparalleled expertise in lot loans and land financing across Florida, offering tailored solutions for every unique situation.

✅ Diverse Options: Explore a wide array of financing options with us, from Florida lot loans to land loans, ensuring you find the perfect match for your land purchase goals.

Strategic Planning: We assist in strategically planning your land purchase in Florida, considering factors like location, loan terms, and future land use.

✅ Personalized Service: Our commitment to personalized service ensures that every client receives detailed attention and support in navigating the land loan process.

✅ Market Insights: Leverage our deep insights into the Florida real estate market to make informed decisions and capitalize on investment opportunities.

Table of Contents

Bennett Capital Partners Land Loan Program

At Bennett Capital Partners, we offer a unique land loan program designed to help you achieve your real estate goals. Our program highlights include:

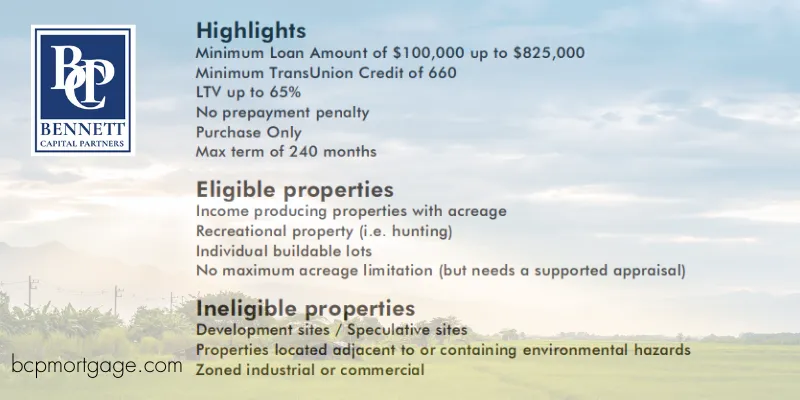

Highlights

■ Fixed Rate - No Balloon

■ Minimum Loan Amount of $100,000 up to $825,000

■ LTV up to 65%

■ No prepayment penalty

■ Purchase Only

■ Max term of 240 months

Eligible Property Types

■ Income producing properties with acreage

■ Recreational property (i.e. hunting)

■ Individual buildable lots

■ No maximum acreage limitation (but needs a supported appraisal)

Ineligible Properties

■ Development sites / Speculative sites

■ Properties located adjacent to or containing environmental hazards

■ Zoned industrial or commercial

How To Qualify

📝 Qualify with Profit & Loss Only, 1 Year Self Employed Allowed, Bank Statements for Income Allowed, and Traditional Income Verification only for 1 year.

Alternate Programs

We also have commercial lot loan programs for vacant lots and development sites, residential bank and portfolio loans, private lending and hard money lot loan programs available. Please reach out to us if you are in need of any land financing needs in the state of Florida

Take the Next Step:

Ready to explore your land loan options?

📅 Schedule a consultation with our expert team at Bennett Capital Partners to discuss your specific needs and how we can assist you.

📈 Click here for current Florida mortgage rates. Prefer to talk?

📞 Call us Today 1-800-457-9057

Understanding the Dynamics of Land Mortgages in Florida

A land mortgage, often referred to as a land loan, is a specific type of financing that enables you to acquire a parcel of land. Unlike conventional home mortgages, land loans necessitate a distinct set of approval criteria. These loans are frequently utilized by individuals aspiring to construct their own homes or by real estate investors scouting for novel opportunities.

In the context of Florida, land mortgages bear a unique significance owing to the state's vibrant history and promising future. Florida's real estate market has witnessed several cycles of boom and bust, predominantly driven by economic factors, population growth, and alterations in land use.

The table below outlines the unique aspects of Lot Loans.

The Historical Allure of Florida's Land

Florida's land has always possessed an undeniable allure, shaped by its favorable climate, picturesque landscapes, and a wealth of natural resources. This allure dates back to the early 20th century, a time marked by a significant real estate boom. Investors from across the nation were drawn to Florida, enticed by the promise of growth and opportunity. However, this period was not without its challenges. Economic downturns led to times of decline, yet the overarching trend in Florida's real estate history has consistently been one of growth and appreciation.

The state's captivating charm continues to this day. Florida's burgeoning population growth and limited land availability have led to a substantial appreciation in land values, making it a prime destination for both residential and commercial real estate investments. This continuous demand, coupled with the state's unique environmental and cultural heritage, underscores Florida's ongoing appeal.

Yet, the historical context of Florida's land sales, particularly the infamous “swamp peddler” era, serves as a cautionary tale. It highlights the importance of working with knowledgeable and ethical professionals in the real estate industry.

By partnering with Bennett Capital Partners, investors, and potential landowners can navigate the intricacies of the Florida land loan and land loan Florida markets with confidence. Our expertise in lot loans Florida and Florida lot loans, and our comprehensive understanding of lot financing ensures that our clients are well-equipped to make informed decisions, avoiding the pitfalls of past land investment schemes.

As we continue to appreciate and invest in Florida's land, it's crucial to remember the lessons from its past – the need for due diligence, ethical practices, and expert guidance in real estate investments. Bennett Capital Partners stands as a beacon of trust and expertise in this dynamic market, helping clients to capture the essence of Florida's historical allure while securing their real estate future.

Early 20th Century Boom and Bust

Florida has long been a destination for its favorable climate, picturesque landscapes, and abundant natural resources. The early 20th century marked a significant real estate boom, drawing investors nationwide. This period of rapid growth, however, was interspersed with economic downturns. Despite these fluctuations, the long-term trend in Florida has been one of growth and appreciation in land value.

The Era of Swamp Peddlers and Land Scams

The 1950s through the 1980s witnessed a transformative era in Florida's real estate history, often marred by dubious land sale practices. As described in Jason Vuic's book "The Swamp Peddlers," this period saw Florida morph from a land of eco-sensitive wetlands and cattle ranches into sprawling subdivisions.

Unscrupulous land scammers, commonly known as swamp peddlers, capitalized on the Florida dream, selling thousands of acres of often undevelopable land to unsuspecting buyers. This era's practices underscore the importance of working with reputable professionals like Bennett Capital Partners to navigate the complexities of Florida's real estate market.

The Ponzi Scheme and its Legacy

The term "Ponzi scheme" originated from Charles Ponzi's infamous land sales in Florida in the 1920s. Ponzi’s fraudulent sales of swamp land, misleadingly marketed as prime property, highlight the risks inherent in land investment without professional guidance. This historical context emphasizes the critical need for potential investors to engage with knowledgeable and trustworthy brokers like Bennett Capital Partners, ensuring safe and informed land purchases.

Modern Florida Real Estate: Growth Amidst Caution

Today, Florida continues to attract a diverse array of individuals and investors. The state's burgeoning population and limited land availability have led to significant appreciation in land values. However, the historical lessons of land scams and the importance of regulatory oversight serve as a reminder of the value of expert advice in real estate investments.

Partnering with Bennett Capital Partners

In navigating the Florida real estate landscape, partnering with Bennett Capital Partners offers clients the assurance of informed, ethical, and professional guidance. Our expertise in Florida land loans, land loans in Florida, and lot financing helps investors and individuals alike to make sound decisions in their real estate ventures, backed by a deep understanding of Florida's unique market dynamics and historical context.

The Investment Potential of Florida's Land

Investing in land in Florida can be a remarkable long-term investment strategy. Land is a tangible asset that, unlike other types of investments, doesn't depreciate. Instead, the value of land typically appreciates over time, especially in high-demand areas like Florida. Additionally, owning land provides opportunities for income generation, whether through development, leasing, or selling at a profit in the future.

However, like any investment, purchasing land comes with its own set of risks and considerations. It's crucial to conduct your research, comprehend the market, and consider your long-term plans for the land. At Bennett Capital Partners, we're here to assist you in navigating the process of securing a land mortgage and making informed decisions about your real estate investments.

Navigating the Land Mortgage Process With Bennett Captial Partners

Embarking on the journey of securing a land mortgage, particularly in the diverse and dynamic Florida real estate market, requires careful navigation and expert guidance. At Bennett Capital Partners, we bring a wealth of experience in facilitating lot loans and financing, ensuring a smooth and successful process for our clients.

Initial Qualifications: The first step in securing a land mortgage with us involves meeting key financial criteria. A strong credit history is vital, and we typically look for a minimum TransUnion Credit score of 660. This initial qualification is crucial in demonstrating financial reliability.

Developing a Comprehensive Land Plan: After meeting financial qualifications, presenting a detailed land plan is crucial for certain financing options, though not required for our fixed rate and residential land program. Whether your plan involves residential construction or commercial development, Bennett Capital Partners is here to offer tailored advice and support, ensuring your vision for the land is realized effectively.

Understanding Florida’s Unique Real Estate Landscape: Florida's real estate history is marked by its distinct cycles of growth and recession, influenced by factors like economic shifts, demographic changes, and evolving land utilization patterns. We recognize that investing in Florida land is not just a financial decision but also a commitment to being part of the state's vibrant future.

Expertise in Florida Land Dynamics: Our deep understanding of Florida's real estate nuances positions us to offer unmatched guidance in land mortgage options. Whether it’s navigating through the complexities of the market or understanding the impact of local regulations, Bennett Capital Partners stands as your expert ally.

Comprehensive Support: From understanding the intricacies of land mortgage applications to finalizing the best financing options, our team is dedicated to providing comprehensive support throughout your land acquisition journey. We believe in building lasting relationships with our clients, offering personalized guidance every step of the way.

Your Trusted Partner in Land Investment: Choosing Bennett Capital Partners means partnering with a firm that not only understands the technicalities of land mortgages but also values the significance of your investment. We are committed to helping you secure the optimal funding resources, ensuring your venture into Florida’s land market is both successful and rewarding.

With Bennett Capital Partners, navigate the land mortgage process with confidence, backed by our expertise and commitment to excellence in the realm of Florida real estate investment.

Conclusion

Securing a land mortgage in Florida and Miami doesn't have to be a daunting process. With the right guidance and a clear understanding of the process, you can secure the financing you need to make your real estate dreams a reality.

At Bennett Capital Partners, we're here to help. Contact us today to learn more about our land loan program and how we can help you navigate the rising tide of real estate in Miami. If you are looking for Fix N Flip loan programs please read our blog post here.

Commonly Asked Questions

How to Get a Lot Loan in Florida?

To get a lot loan in Florida, it's important to understand your financial standing and the purpose of the land. At Bennett Capital Partners, we guide clients through the process of securing lot loans in Florida, including both florida lot loans and lot loan florida options, ensuring they find terms suitable for their specific needs.

What are the Differences Between Land Loan Florida and Lot Loans Florida?

The main difference lies in the intended use of the land. Land loan Florida options typically cater to larger, potentially commercial plots, while lot loans Florida are often for smaller residential or personal-use lands. Bennett Capital Partners specializes in navigating these distinctions for our clients.

What Should I Consider When Applying for Florida Land Loans?

When considering florida land loans, factors such as down payment requirements, interest rates, and the land’s potential uses are crucial. Our team at Bennett Capital Partners excels in matching clients with the right lenders for their specific land loans in Florida needs.

Why is Bennett Capital Partners the Go-To for Land Loans in Florida?

Choosing Bennett Capital Partners for land loans in Florida means you gain access to our extensive network of lenders and our expertise in the specific requirements of both florida land loan and land loans Florida options, ensuring you find the best match for your land purchasing goals.

How Can Bennett Capital Partners Assist with Lot Financing in Florida?

Bennett Capital Partners assists with lot financing in Florida by offering expert advice and access to a range of lenders. We help our clients understand their options and navigate the complexities of the lot loan market in Florida, ensuring they secure the best terms.

What Benefits Do I Get by Working with a Broker for Florida Land Loans and Lot Loans?

Working with Bennett Capital Partners, a broker for Florida land loans and lot loans, provides the benefit of a knowledgeable partner who can navigate the various lending options, helping you to understand and choose the best florida land loan or lot financing solution that meets your needs.

FAQs

What is a land loan?

A land loan is a type of financing that allows you to purchase a plot of land. They are typically used by individuals who want to secure a specific location but are not yet ready to begin construction.

How does a land loan work?

A land loan works similarly to a traditional loan. However, the loan is secured against the plot of land you intend to purchase. The loan amount is typically based on the appraisal value of the lot.

How much is a down payment for a lot?

The down payment for a lot loan is typically higher than that of a traditional mortgage. It can range from 20% to 50% of the purchase price.

Is it better to buy land or a house?

The decision to buy land or a house depends on your individual needs and circumstances. Buying land allows you the freedom to design and build your dream home. However, it can also require a larger upfront investment and more planning.

How can I finance a lot loan?

Financing a lot loan can be done through various lenders including banks, non-banks, and hard money lenders. It's important to compare different loan offers to find the one that best suits your needs.

Philip Bennett

Philip is the owner and principal mortgage broker at Bennett Capital Partners, Business NMLS# 2046828. He earned his degree in Accounting and Finance from Binghamton University and holds a Master's Degree in Finance from NOVA Southeastern University. With over 20 years of experience in the mortgage industry, Philip has been a leader in his field and has personally originated over $2 billion in residential and commercial mortgages.

Learn more about Philip Bennett's background and experience on our Founder's page. Whether you're a first-time homebuyer or a seasoned real estate investor, our team is here to help you achieve your real estate goals. Don't wait any longer, contact us today and let us help you find the right mortgage for your needs.

Discover helpful tips and tricks on mortgages by reading our blog posts